La liquidation simplifiée d’une société au Luxembourg

Il existe, dans l’esprit du public, une certaine confusion entre les termes de «dissolution», «liquidation», «liquidation simplifié», «liquidation judiciaire», etc. Cette confusion est entretenue par le législateur lui-même :

• L’article 1865 bis du code civil parle d’une dissolution sans qu’il ait lieu à liquidation ;

• L’article 141 de la loi sur les sociétés commerciales indique qu’après leur dissolution les sociétés continuent d’exister pour leur liquidation;

• La section XII bis de cette même loi traite « de la dissolution et de la fermeture judiciaires des sociétés commerciales ».

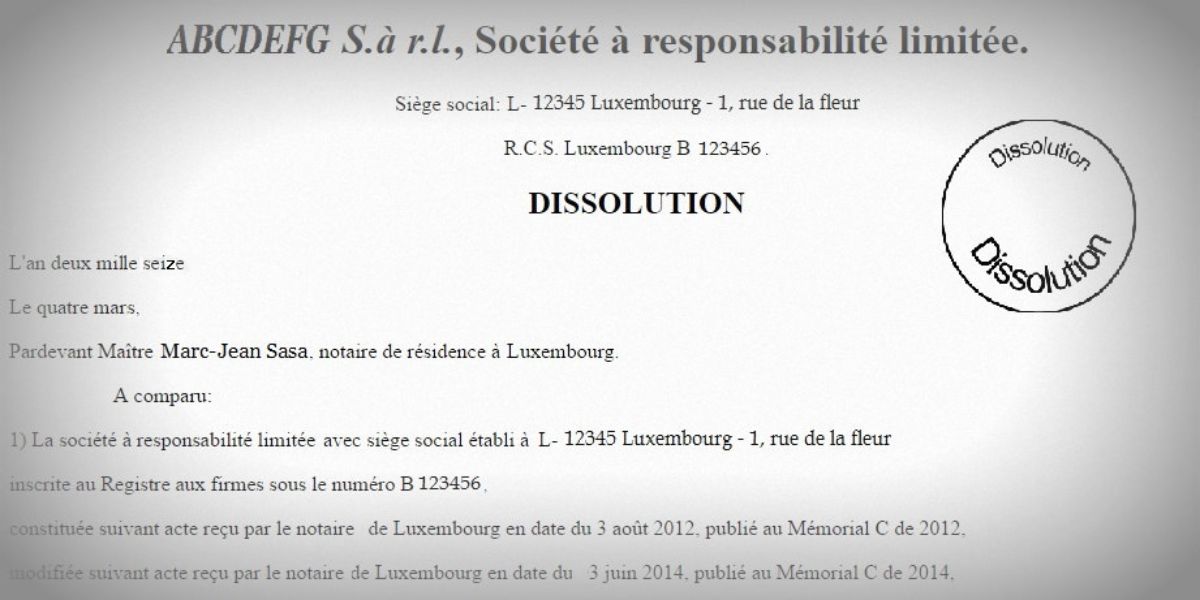

Deux types de dissolution sont en fait possibles : la dissolution volontaire ou la dissolution contrainte (aveu de faillite ou liquidation judiciaire). Ces deux dissolutions sont suivies, selon les cas, d’une période de liquidation plus ou moins longue et contraignante.

En ce qui concerne les liquidations volontaires, la pratique a conduit (en s’appuyant sur l’article 1865 bis du code civil) à instaurer une «liquidation simplifiée» que la loi du 10 août 2016 pérennise.

La réunion de toutes les parts entre une seule main

Selon les cas, les actes nécessaires à la liquidation sont plus ou moins complexes. Dans le cas où l’associé possède l’intégralité du capital de la société et donc la totalité de l’actif et du passif, il est apparu qu’il était très long et très lourd de suivre toutes les procédures. En effet, les actes exigés par une liquidation classique sont partiellement inutiles puisqu'il n'y a pas de boni à répartir équitablement entre les associés.

La loi de modernisation du droit des sociétés

La loi de modernisation du droit des sociétés1a voulu conforter les notaires dans l’idée qu’ils pouvaient procéder à de telles dissolutions sans liquidation dans les cas où la société ne compte qu’un associé en modifiant l’article 141 LSC et précise les pièces à apporter lors de l’assemblée générale de dissolution.

Auparavant, des liquidations simplifiées avaient lieu, mais ces opérations n’étaient pas réellement encadrées. La pratique de chaque notaire était différente et certains d’entre eux ne le faisaient même pas.

Aujourd’hui, la loi permet d’harmoniser les règles et tout associé/actionnaire peut décider de dissoudre rapidement la société à condition que toutes les parts/actions de la société soient entre ses mains (article 1865 bis du code civil, inchangé) et à condition que la société obtienne au préalable des attestations prouvant qu’elle est à jour de ses cotisations. Il s’agit d’attestations :

• Du centre commun de la sécurité sociale ;

• De l’administration des contributions directes ;

• De l’administration de l’enregistrement et des domaines.

Pour mener à bien la liquidation simplifiée, l’associé doit fournir ces attestations au notaire et ce, à une date qui ne peut ni être antérieure de 3 mois au jour de l’acte de dissolution, ni postérieure à ce même acte.

Par ailleurs, l’article 1865 bis prévoit la protection des créanciers de la société. En effet, les créanciers pourront, dans la période de 30 jours à compter de la publication de l’acte de dissolution, obtenir des sûretés.

Cette nouvelle loi, si elle conforte une pratique devenue courante, vise surtout à harmoniser les règles et à protéger plus efficacement l’administration luxembourgeoise de la défaillance des associés de la société dissoute.

Cette possibilité est cependant, à notre avis, à réserver au seul cas où l'associé unique est une personne physique. Dans le cas où l'associé est une personne morale, il conviendra plutôt d'en passer par la procédure de fusion simplifiée.

(1) Loi du 10 août 2016 portant modernisation de la loi modifiée du 10 août 1915 concernant les sociétés commerciales