Mandatory VAT information on invoices

Following the transposition of European Directive 2010/45/EU into Luxembourg law, taxable persons (assujettis) established in Luxembourg must comply with a set of mandatory invoice requirements when issuing an invoice.

These obligations fall within the framework of harmonizing the legal value of invoices across the European Union.

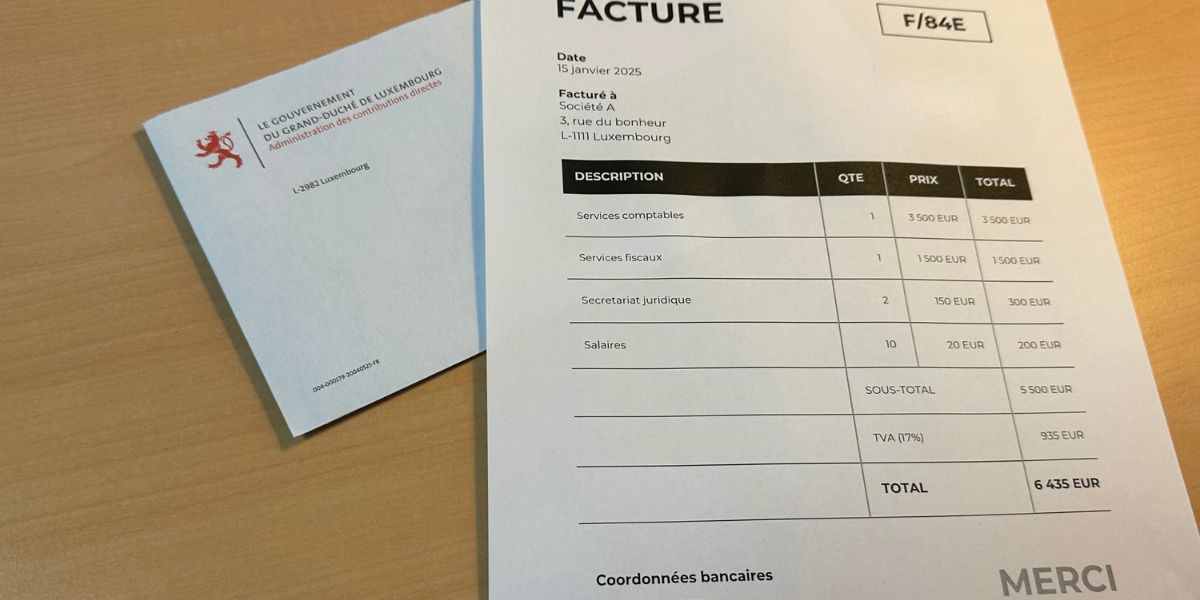

In this context, every invoice issued by a Luxembourg taxable person must include the following information:

- Date of invoice issuance;

- A sequential invoice number, based on one or more series, which uniquely identifies the invoice;

- The VAT identification number of the taxable person making the sale;

- The VAT identification number of the purchaser, in the case of an intra-Community sale;

- The full name and address of both the taxable person and the purchaser or the recipient of the service;

- The quantity and nature of the goods delivered or the scope and nature of the services rendered;

- The date on which the delivery of goods or the provision of services is carried out or completed, or the date on which a down payment is made, if applicable;

- The wording “Comptabilité de caisse” (cash accounting scheme) when VAT becomes chargeable upon receipt of payment (under the cash-based VAT system);

- The taxable amount for each rate or exemption, the unit price excluding VAT, as well as any discounts, rebates, or reductions if they are not included in the unit price;

- The VAT rate applied;

- The amount of VAT to be paid, unless a special scheme applies;

- When the buyer or the service recipient issues the invoice on behalf of the supplier or service provider, the mention “Self-billing” (“Autofacturation”);

- In the case of exemption, a reference to the applicable provision of the amended Luxembourg VAT Law of 12 February 1979 (LVL), or any other indication that the supply of goods or services is exempt;

- Where the buyer or recipient is liable for the VAT, the mention “Reverse charge” (“Autoliquidation”);

- In the case of supplying a new means of transport, the data set out in Article 4(4)(b) LVL;

- In the event of applying the special scheme for travel agents referred to in Article 56bis LVL, the mention “Special scheme – travel agents”;

- In the event of applying the margin scheme referred to in Article 56ter-1 LVL, the mention “Special scheme – second-hand goods,” “Special scheme – works of art,” or “Special scheme – collector’s items and antiques”;

- Where the person liable for the tax is a tax representative within the meaning of Article 66bis LVL, the VAT identification number of that tax representative along with their full name and address.

Important note: Invoices must also include the business license number (numéro d’autorisation d’établissement), the RCS number (Company Register) and the legal form of the entity issuing the invoice. By way of exception, the invoice must be issued in the name, under the address, and under the auxiliary identification number of the member of the VAT group that is the originator of the taxable operation.

Simplified invoice

When the total amount of the invoice, including tax, does not exceed EUR 100, or if the taxable person benefits from the VAT exemption scheme, they may issue an invoice containing the following information:

- The date of invoice issuance;

- Identification of the taxable person delivering the goods or providing the services;

- Identification of the types of goods delivered or services provided;

- The amount of VAT to be paid, or the information needed to calculate it;

- If a corrective invoice is issued, a specific and unambiguous reference to the original invoice and the specific modified details.

Electronic invoice

Luxembourg legislation recognizes the validity of electronic invoices1, provided they contain all the information required for paper invoices.

- Prior acceptance: The recipient must have given prior consent to receiving the invoice electronically.

- Allowed formats: Any electronic format is accepted (JPEG, PDF, XML, etc.), as long as it preserves the authenticity of origin and integrity of content.

Under the provisions of Directive 2014/55/EU on electronic invoicing in public procurement, e-invoicing is mandatory for certain public contracts. Although it does not apply to all B2B transactions, this development reflects the desire to encourage the digitization of invoicing processes.

Invoicing deadline

When an invoice is mandatory, it must be issued no later than the 15th day of the month following the one in which the goods or services were delivered. If the invoice is issued within this legal timeframe (i.e., by the 15th day of the following month), VAT becomes chargeable on the date the invoice is issued. Should the taxable person fail to issue the invoice in due time, the tax nevertheless becomes chargeable at the end of this period2.

Deduction right

The right to deduct arises when the VAT becomes chargeable, and the taxable person claiming it must hold a proper invoice containing all the information stated in this article.

Late payment interest

Businesses must explicitly indicate on invoices issued to private consumers that it automatically generate interest at the legal rate as from the end of the 3rd month following receipt of the goods, completion of the work, or the provision of services.

Conclusion

To ensure full compliance with the law, each invoice—whether in paper form or electronic—must include all mandatory information.

Failure to meet these requirements can result in VAT deduction challenges and may subject the business to tax audits and possible penalties. Furthermore, for control purposes, the VAT administration can request a French or German translation of in voices concerning goods or services supplied in Luxembourg, as well as invoices received by a taxable person established in Luxembourg, when the invoices are in a foreign language.

By observing these obligations, a business complies with both Luxembourgish and EU law, thus ensuring the fiscal validity of its invoices.

1. Article 63 LVL.

2. Article 24§2.b) LVL.