INDIVIDUAL TAXATION IN LUXEMBOURG

The Luxembourg tax reform which came into force on 1 January 2017 contains several new legal and regulatory provisions, in particular on the taxation of married couples who may, from the 2018 tax year, choose between individual or collective taxation. This option applies to both resident and non-resident (cross-border) taxpayers.

TAXATION OF NON-RESIDENTS

Before the tax reform

Until this reform, married non-resident taxpayers obtained tax class either 2 or 1a depending on the threshold of 50% of the household's professional income, whether or not it was earned in Luxembourg.

In addition, they could be treated the same as residents for tax purposes if at least 90% of their professional income* was earned in Luxembourg**. Where applicable, taxpayers were obliged to file a Luxembourg tax return and taxation was collective.

For taxpayers who were not subject to taxation by means of a tax base, the withholding tax on Luxembourg source income could be considered as final taxation.

If each of the spouses composing the household received a taxable professional income in Luxembourg, taxation was collective.

After the tax reform

The general rule now provides that non-resident married couples apply tax class 1. Each spouse is taxed separately on his or her own realised income (individual taxation).

However, it is still possible for non-resident married couples to be treated for tax purposes as residents if at least 90% of their worldwide income* is earned in Luxembourg** or if their annual income from non-Luxembourg sources does not exceed 13,000 euros.

Where applicable, the withholding tax will be withheld at source by applying a rate which, upon request, will be entered on the tax withholding form provided that both spouses make it jointly, which also implies taxation by means of a tax base.

Individual or collective taxation may be performed on the condition that the application is joint.

TAXATION OF RESIDENTS

Before the tax reform

Resident married couples automatically obtained tax class 2 without any income or threshold conditions.

Taxation was collective for taxpayers who were obliged to file a Luxembourg tax return.

As for non-resident taxpayers, the Luxembourg withholding tax on income from Luxembourg sources could be considered as final taxation for resident taxpayers not subject to taxation by means of a tax base.

After the tax reform

From the 2018 tax year, married resident taxpayers will be able to opt for either collective or individual taxation. The application for individualisation must be joint.

INDIVIDUAL TAXATION

From the 2018 tax year onwards, resident and non-resident married couples will be:

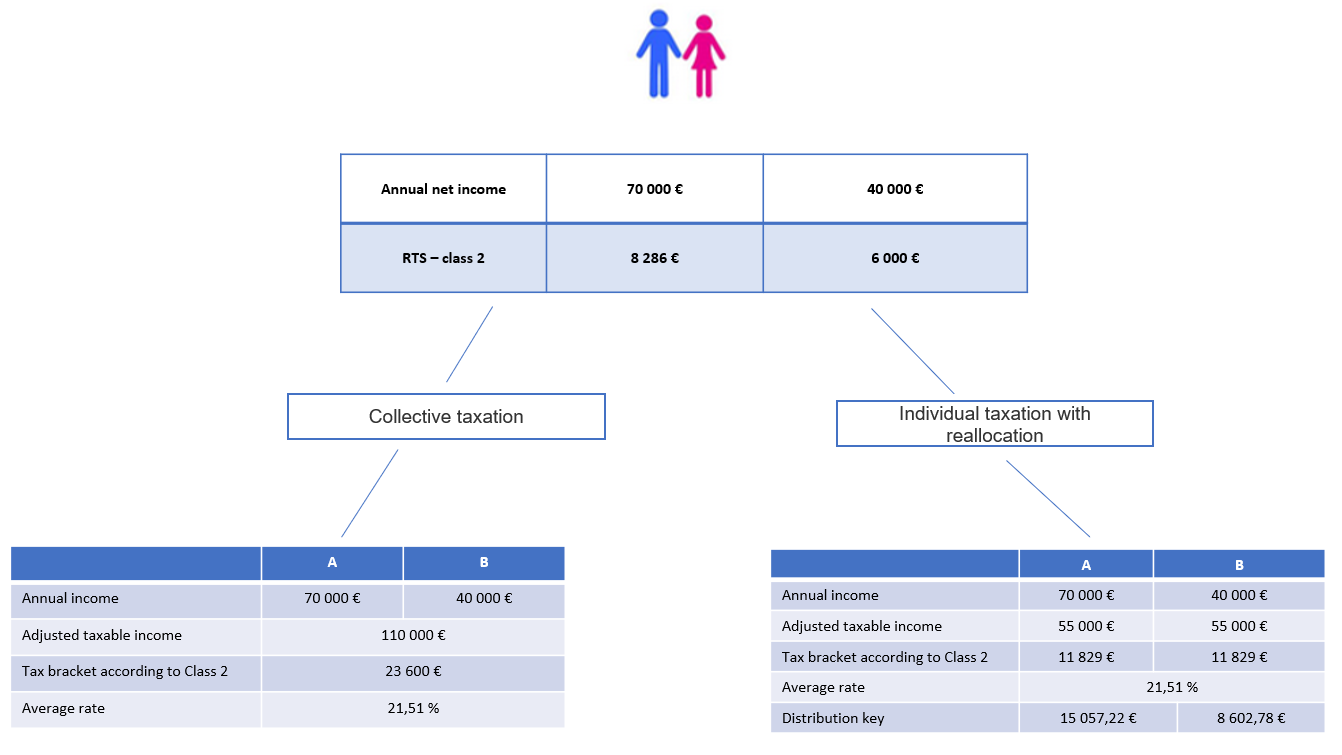

- Taxed collectively in tax class 2, according to the principle of collective taxation and by accumulating income;

- Taxed on a purely individual basis or individually by reallocation of the common taxable income, which allows an average tax rate to be determined.

Married couples who wish to apply for individual taxation will thus be taxed according to the scale for tax class 1.

The various allowances or special expenses are granted to each spouse at a rate of 50% of the thresholds

Whereas purely individual taxation allows each spouse to pay tax on his or her own income and according to the scale of tax class 1 by applying an individual rate, individual taxation by reallocation allows a common tax rate to be defined for both spouses so that each spouse pays tax on his or her own income.

The procedures

The choice of individual taxation must be made on joint application but may be changed at any time during the year and at the latest when the tax return is submitted (for the year concerned). In return, this will lead to the abandonment of the quarterly advances that were requested at the time of collective taxation.

(*) For Belgian residents, this threshold is 50% of the professional income of the household.

(**) At least one of the spouses in the household must satisfy this condition.

.jpg)