DEPENDENT CHILDREN AND TAX BENEFITS

While the tax benefits available to taxpayers with one or more children remain unchanged, a new reform concerning family allowances has shaken up the start of the 2016 school year. The aim of this reform is to approach the future of each child in the same way and to ensure that each of them receives the same family allowance

Tax benefits

When one or more children make up a household, taxpayers (married or unmarried) benefit from certain tax advantages, such as:

- A child tax reduction of €922.50 per year per child either in the form of a child bonus* or tax relief;

- Increased deductions depending on the number of children.

Single taxpayers (tax class 1A) are entitled to child tax relief and a single-parent tax credit of €1,500 if their taxable income is less than €35,000. For taxable income between €35,000 and €105,000, it is progressively reduced to €750. Above €105,000 it is maintained at €750.

Taxpayers who pay child support to children who are not part of the household can benefit from an allowance of up to €4020 per year and per child on their taxable income.

Allowances and their amount

- Family allowance

With the reform applied since 1 August 2016 the amount of the family allowance has increased from €262.48 to €265 per month:

→ Each child born from 1 August 2016 until the age of 18; -> Households with only one child.

The family allowance and the bonus are now combined to form a single lump sum. Before this reform came into force, the amount varied according to the number of children in the household.

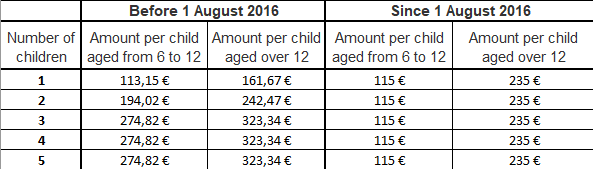

Households which received the allowance before the reform are not affected by this change and the amount they receive is unchanged. From the age of 6, each child is entitled to an extra €20 and from the age of 12 an extra €50.

- Back to school in 2016

The amount of the back-to-school allowance has also been also changed. It will be €115 for children aged between 6 and 12 years old and €235 for children over 12 years old.

As we know, the family allowance is a financial benefit designed to help households with the upbringing and maintenance of children by compensating for family expenses.

This benefit is intended for each child from birth until the age of 18 if he or she meets one of the following conditions:

- For residents:

- Legal domicile in Luxembourg; - Effective and continuous residence in Luxembourg.

- For non-residents:

- Residence in an EU country and being a member of a family with one parent working in Luxembourg and affiliated to the CCSS.

|

Both parents work in Luxembourg |

One parent works in Luxembourg and raises the children alone |

One parent works in Luxembourg and the other in their country of residence |

|

Family benefits of Luxembourg |

Family benefits of Luxembourg |

Family benefits of the country of residence. If the amount of the benefits is lower than that which would have been paid by Luxembourg, Luxembourg pays the difference, called the “differential supplement” |

- The special case of stepfamilies

The summer 2016 summer reform of allowances also affects stepfamilies. The children of spouses or partners not residing in Luxembourg are no longer considered to be family members and no longer receive Luxembourg family allowances.

*The bonus represents an "automatic bonus", i.e. an automatic allocation in the form of a benefit of the child tax reduction previously deducted from the payroll tax deducted at source. The child bonus has the dual character of a tax measure and a family benefit.

.jpg)