THE CARRY-OVER OF TAX LOSSES

Tax losses incurred by a company during a tax year can be carried forward and, in principle, offset against taxable profits in subsequent years, thereby reducing the amount of tax payable. There are, however, restrictions on carry-forward and set-off.

Temporal limit on loss carry-forwards

Tax losses incurred prior to 31st December 2016 may be carried forward indefinitely.

Tax losses incurred after 1st January 2017 may be carried forward to the following 17 years1.

The tax deferral of losses also assumes that the company keeps regular accounts and that its activity remains unchanged.

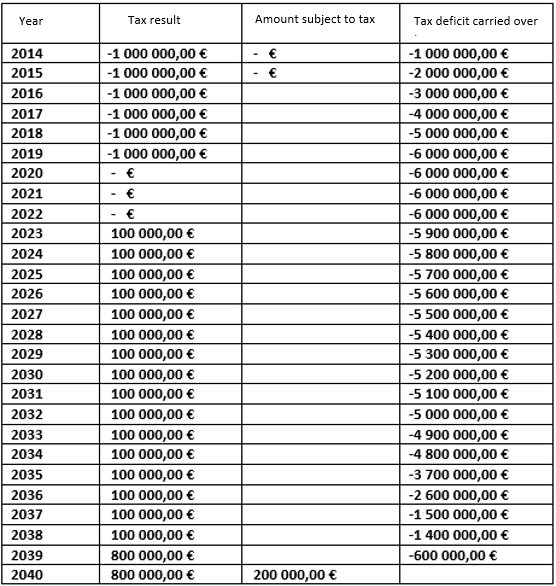

Example of application

.2024-10-08-14-01-52.png)

Due to the 17-year limitation of tax losses, losses for the years 2017, 2018 and 2019 can no longer be carried forward from the respective years 2035, 2036 and 2037.

Substantive limits

However, the Tax Authorities are careful to limit the taxpayer's ability to set off tax losses by raising the abuse of law argument whenever they consider that the tax saving resulting from this set-off is unjustified.

Abuse of rights2 is, in essence, a provision of tax law that allows a taxpayer's tax organisation to be disregarded if it has the effect of reducing or avoiding tax by artificially setting up a clever scheme that is essentially aimed at tax saving.

Initially, case law broadly followed the Administration's abuse of law reasoning by denying the benefit of tax loss deduction to a company that had completely changed both its shareholding and its activity before requesting the deduction of losses3.

However, case law subsequently tempered this position by admitting another taxpayer's right to offset tax losses even though the company's activity had effectively changed while its shareholding remained unchanged4.

1. Article 114 of the L.I.R. tax law

2. §6 StAnpGS

3. Court of Appeal February 16th 2016 roll #35978

4. Court of Appeal April 25th 2024 roll #48917