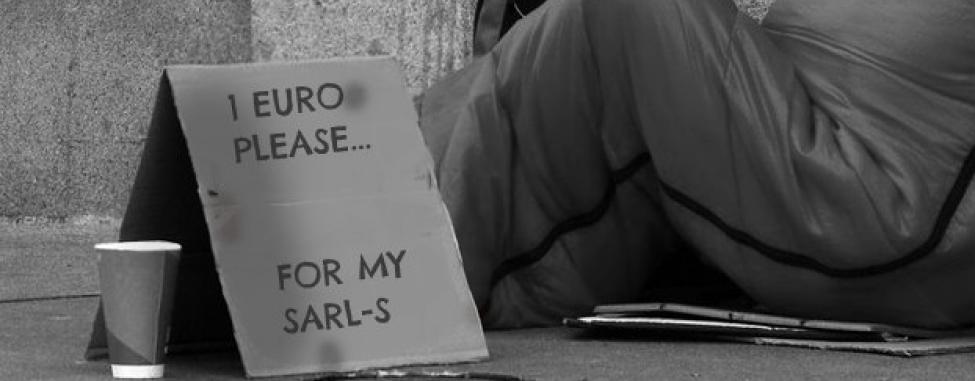

Simplified LLC, 1 euro and limits

Simplified Limited Liability Companies (Simplified LLCs) are a variant of the LLC with a few exceptions to the rules governing the typical limited liability company1.

The purpose of the introduction of simplified LLCs / 1€ Companies is to favor entrepreneurship (by limiting administrative constraints) and to support growth. This kind of structure goes hand in hand with today's tendency to ease the formation of new companies.

Simplified LLCs are different from LLCs on four major counts :

• Amount of capital ;

• Shareholder status ;

• Management ;

• Procurement of a business license.

1- Social capital : main innovation

The formation of a simplified LLC does not require an important amount of money. The law sets the minimum amount of social capital at 1€. The maximum amount is 12.000€, which is the minimal amount to set up a regular LLC. Hence, the simplified LLC becomes a regular LLC if its social capital crosses that threshold.

This minimum and maximum demonstrate the will to limit the access of this form of company to entrepreneurs who consider an asset light business model.

Legal reserve

A simplified LLC must allocate 5% of its net profits to an unavailable reserve. This obligation ceases when the sum of social capital and reserves equals the maximum amount of social capital for a simplified LLC (12.000€).

Modification of social capital

It is important to note that a capital increase or decrease of a simplified LLC requires a modification of the statuts. The change in capital must be decided by the majority of shareholders representing at least three quarters of the capital.

The increase in capital can be done by means of contribution :

- In kind : in this case the services of an auditor are not required ;

- In cash.

2- Shareholders

A feature of the 1€ LLC is the obligation for shareholders to be private individuals². If a legal person became shareholder of a simplified LLC, the company would be void.

Like the institution of a maximum limit for the capital, the restriction of access to private individuals aims to avoid the entry into the capital of simplified LLCs of institutional investors and to favor business creation among young entrepreneurs.

Furthermore, a private person cannot become a shareholder of several simplified LLCs in order to avoid the multiplication of company formations by the same private person. If that was allowed, some individuals might create multiple undercapitalized and random projects.

Nonetheless, if a private person wants to become a shareholder in two simplified LLCs, they become personally responsible for the debts of the second simplified LLC.

Shareholders' liability

Shareholders' liability is limited to their contributions. However, if a private individual is a shareholder in several 1€ LLCs, he becomes liable for the additional simplified LLCs.

Simplified LLCs can be comprised of 1 to 100 shareholders, although this type of structure is best suited for individual entrepreneurs.

Rights of shareholders :

- The right to attend to assemblies and participate in decisions ;

- To vote on resolutions in different domains (modification of statuts, approval of annual accounts) ;

- To receive dividends (distribution decided by the General Assembly of Sharholders).

Transfer of shares

The shares of a 1€ LLC are required to be nominative.

The sale of shares can either be done between shareholders (without restrictions) or to third parties. The sale of shares to third parties is more complex and must follow agreement and notification procedures imposed by articles 189 and 190 of the Company Law and as a result must :

- Be authorized by a vote of the General Assembly taken at the majority of shareholders representing at least (unless exception in the status) three quarters of the capital ;

- Be notified to the company or accepted by it as required by article 1690 of the Civil Code.

3- Management body

Managers are appointed by the shareholders, either in the status or subsequently. This appointment can be limited in time or unlimited.

The managers of a simplified LLC have the same responsibilities as the managers of a regular LLC or of the directors of a PLC3.

A simplified LLC is managed by one or more private person agents4. They are liable towards the company and towards third parties.

Managers represent the company when acting with third parties and must accomplish every act pertaining to the achievement of the corporate purpose of the company.

4- Business license

A simplified LLC can only be formed with the aim of performing commercial, artisanal, industrial or intellectual activities. These activities imply the possession of a business license.

The application for a business license must be addressed at the General Direction of the Small and Medium Enterprises and Entrepreneurs department of the Ministry of Finance. The application must contain the following information :

- The identity of the applicant and the activity he or she plans on performing ;

- A description of previously performed activities ;

- Proof of respectability and competency ;

- Proof of having adequate equipment.

Processing the application takes a maximum of three months. The absence of a response from the administration within those three months is regarded as tacit5 acceptance of the application.

Once formed, simplified LLCs must remain in compliance with regulations set in the Law related to business licenses. Among other things, effective management of the company must be carried by the authorized manager.

Limits of simplified LLCs

The formation of a 1€ LLC brings some flexibility for entrepreneurs but also comprises some drawbacks :

- The risk for entrepreneurs to believe that the formation of a simplified LLC is “easy penny” and that it does not require any real thought or professional advice ;

- Distrust of entrepreneurs who can only be shareholders in one simplified LLC. They are limited if they want to constitute several simplified LLCs with different activities ;

- The Law on business licenses can hinder some young entrepreneurs facing seemingly complex administrative procedures.

Simplified LLCs definitely hold their place in Luxembourg and come into a dynamic period of economic diversification. This structure allows for an easier access to entrepreneurship. This is a real advantage for young entrepreneurs. However, it is important to state that the formation of a simplified LLC requires resources and that the inception of a capital of 1€ is not synonymous with simplicity.

1art 202 of Company Law

²art 202-2 of Company Law

³art 59 of Company Law

4art 202-6 of Company Law

5art 31 of the Law related to business licenses

Fiduciary

Fiduciary